Case Study: Aangine

at Yapı Kredi Bank

Automated Portfolio

Planning at Yapı Kredi Bank

Profile: Finance;

Industry: a nationwide commercial bank

Ownership: UniCredit and Koç Holding

Employees: More than 18,500

Customers: More than 13 million

Branches: More than 850

Country: Turkey

Established: 1944

This case study shares the benefits of the Automated approach to Portfolio Planning, and also shares the actual impact on people and processes as experienced by Yapı Kredi.

As you can read for yourself, putting Aangine as a tool in place helped all stakeholders to increase the benefits of their Project Portfolio, making the planning process faster, more agile and iterative, and essentially more enjoyable for all stakeholders involved.

1. Manual Approach to Planning

Let us start by sharing the initial as-is state of Portfolio Planning, prior to putting Aangine in action. As part of the Demand Management process, all Project Requests were collected via Micro Focus PPM (formerly HP PPM) and passed through the formal evaluation workflow.

Those approved were extracted into the MS Excel spreadsheet as an input for Portfolio Planning, a roadmap planning cycle driven by the PMO and worked on together with the Business Units, Resource Managers and Project

Managers. That is where the Manual-side of the Planning always started.

Each Project Request then was discussed and stakeholders were making estimations on how much time it would take to deliver each project and most importantly how much effort would be involved. All information was centrally recorded within a shared set of MS Excel spreadsheets. Such approach led to plenty of collaboration bottlenecks as one can imagine.

Imagine the teams capturing all effort estimates for Demands, Ideas and Project Requests, their duration and details of the resource pools involved. And all this had to be entered into the spreadsheets. At any point of time, it turned out to be a struggle to get project data to the same level of detail and quality. Effectively only at the end of the analysis stage was the first combined and accurate snapshot was visible.

It is believed to take place about a month to estimate the duration and effort needed to deliver the projects. Having a manual approach, there was very limited possibility of running a scenario planning due to two reasons. First, the quality and quantity of estimates kept changing during the planning period. Second, having solid information on the capacity of resource-pools available for the projects kept changing, and without having a solid data in hand, any scenario planning turns inaccurate in every case.

There were high-level rules agreed among PMO and the Business Units to come up during the first draft of the roadmap plan. Each BU was given a certain number of projects to prioritise, leaving all other projects under the line for delivery. Imagine about 500 projects aimed for the year, each BU getting their share of this number. That itself limited the innovation as BUs were pushed to come up with only a limited number of projects.

The initial draft of the Portfolio Plan was produced by the PMO, highlighting the potential challenges in capacity and timelines to deliver each project. This was very manual and time-demanding work.

Afterwards, the plan could be shown to the Business Units, for the first time really. Each Business Unit viewed the plan and needed some extra time just to understand it fully. And conversations between the Business Units and PMO started — to come up with the best Portfolio Plan. All discussions could only be supported only by static data available in Excel spreadsheets.

Any change made to the roadmap needed time-extensive manual re-planning, and effectively could not be done during the meeting. Hence discussions had only a limited tendency to be driven by data as there was no scenario planning capability available to stakeholders.

In summary, the total Portfolio Planning process, to agree on the project roadmap for the upcoming year, required 4 months. The planning was a project by itself, with several milestones included: gathering Project Requests, estimat ing and modelling and the capacity available for project delivery next year, ana lysing the Projects to prioritise them and to understand their strategic alignment and NPV, estimating the effort to deliver all Projects — so that finally the 1 sce nario could be produced manually, discussed and fine-tuned.

2. Automating the Portfolio Planning

Putting Aangine in action as a planning tool required no change in process and roles involved and in culture, while bringing significant benefits to the individual stakeholders during the planning, and to the bank while delivering the projects.

From the high-level perspective there are lots of stakeholders involved in Port folio Planning at Yapı Kredi: Directors of Business Units (internal customers for PMO and IT), Portfolio Managers, Head of PMO, IT Project Managers, Business Project Managers, Managers of IT Development teams, IT Budgeting Department and IT Architecture Department.

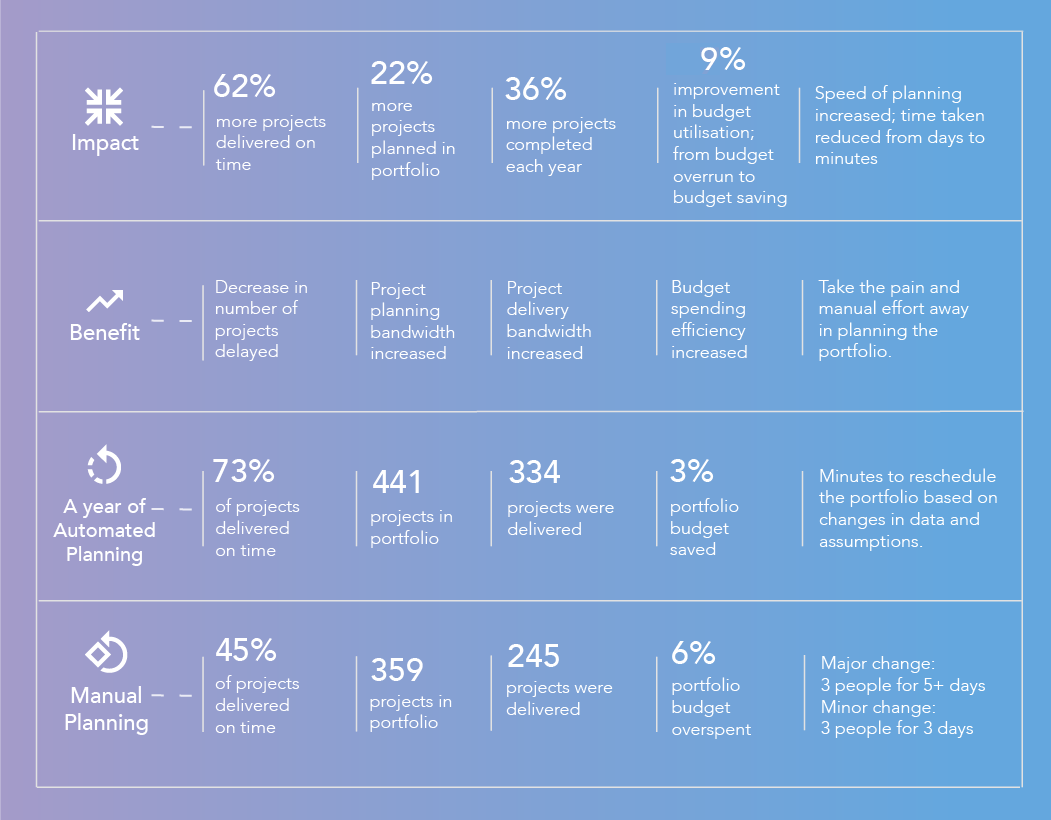

Before starting to use Aangine, YKB captured their actual project success carefully for the previous year for their manually planned portfolio.

Aangine was used for the initial annual planning first. While preparing for the ac tual planning, Yapı Kredi stakeholders discovered the amazing flexibility enabled by the automated tool. They could:

- Apply changes to the portfolio easily and quickly.

- Visualise the impact of changes on scenarios immediately.

- Have Business Units to evaluate the scenarios either instantly during the meetings with PMO or over the course of just a few days, instead of taking weeks to do so compared to manual-planningapproach.

- Eliminate unnecessary delays in planning by PMO team having to spend up to a week just to incorporate even small changes into the Portfolio Plan (more details in the table under Scenario Planning stage).

- Giving power to the stakeholders to access the updated and always accurate roadmap at any time during the planning stage.

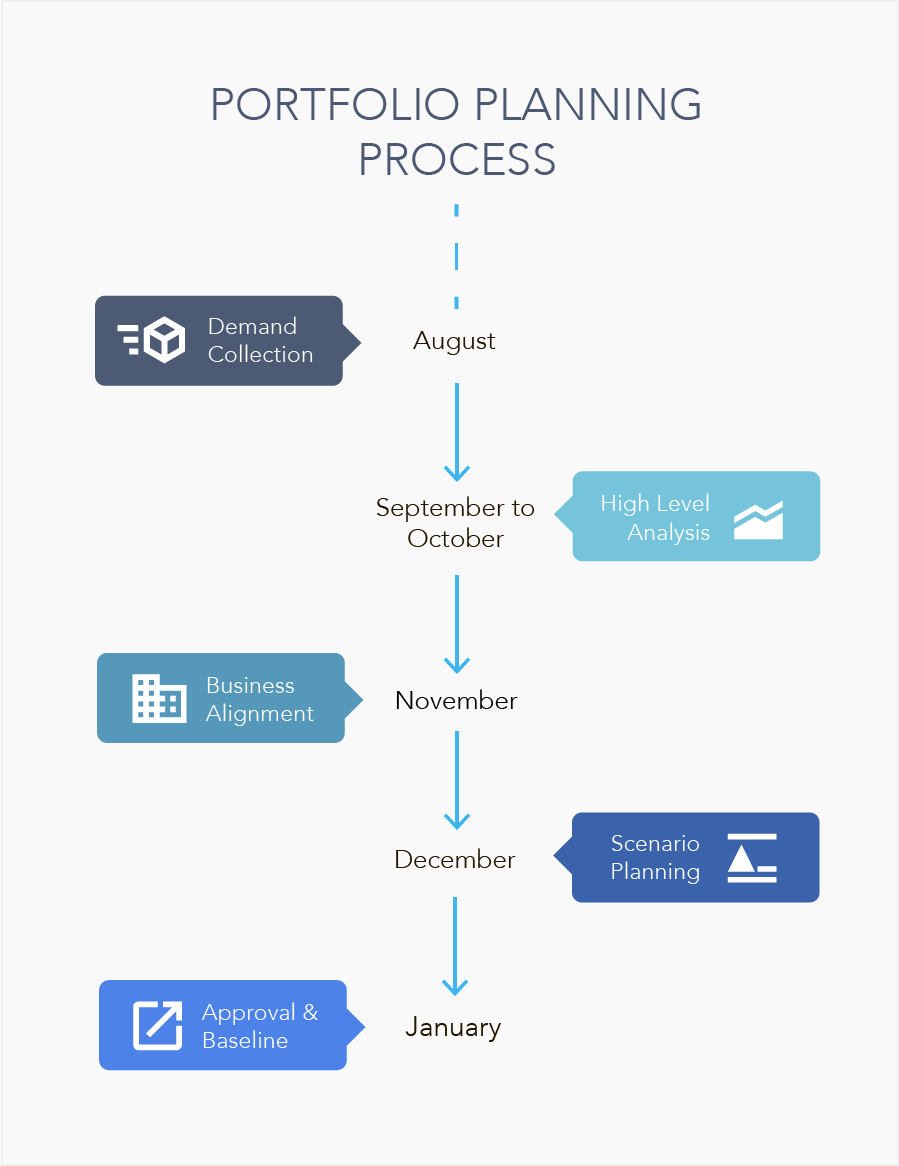

The planning process remained the same as before after Yapı Kredi started to leverage Aangine for Portfolio Planning.

Aangine enabled the stakeholders to be agile and iterative in the Scenario Planning stage, and thus achieve the benefits.

2.1 Impact on People Processes

The table below focuses on the last 2 stages of Yapı Kredi’s process — on Scenario Planning stage and Approval & Baseline stage.

You can read in details the actual struggles of the manual approach and com pare it with a positive impact of Aangine.

| Portfolio Planning Phases | Traditional XLS-way | Impact of Aangine |

|---|---|---|

| Demand Collection | Yapı Kredi decided to keep collecting Demand via Micro Focus PPM. The process and engagement of stakeholders remained unchanged after go-live with Aangine. Project Requests at Yapı Kredi are submitted by Project Requestors to Micro Focus PPM (formerly HP PPM). | N/A (refer to Scenario Planning phase) |

| High Level Analysis | Aangine does not actively support High Level Analysis stage. The process and engagement of stakeholders remained unchanged after go-live with Aangine. During this stage, Micro Focus PPM (formerly HP PPM) tool automates workflows to understand the demand, prepare a draft business case, and estimate the effort needed to deliver the projects. Yapı Kredi uses an Excel-based macro-supported spreadsheet to estimate the project efforts. | N/A (refer to Scenario Planning phase) |

| Business Alignment | Aangine does not actively support the Business Alignment stage. The business alignment score is calculated based on a set of criteria, including alignment to strategy and NPV. The outcomes of Business Alignment in a form of Business Align- ment Score gets imported to Aangine from Micro Focus PPM (formerly HP PPM). The process and interactive of stakeholders during the Business Alignment stage had remained unchanged after go-live with Aangine. | N/A (refer to Scenario Planning phase) |

| Portfolio Planning Phases | Traditional XLS-way | Usage of Aaangine | Impact of Aangine |

|---|---|---|---|

| Scenario Planning | Effectively Yapı Kredi could only plan and work with just a single scenario; due to the amount of work needed to keep a set of Excel spread- sheets reasonably up to date. Imagine that it had taken an effort of 3 PMO specialists for 3 days making even a minor set of project-level changes into the scenario. A major change, e.g. in the split of internal capacity versus outsourced develop- ment capacity, let to 5+ days of extra back office work of 3 PMO specialists updating the scenario. But the major limitation came from the possibility to work with just one scenario. | Aangine shines in this step via its Scenario Planning functionality. The stakeholders first agree on the planning criteria, make decision on the capacity provided internally and procured externally. The decisions are entered into Aangine as a set of rules and criteria, thus Aangine can produce the initial plan. The initial plan is then reviewed by the Business Units in details, coming back to the planning table with the set of required changes. Aangine takes the changes in and produces alternative scenari- os. As you can see, the planning instantly becomes more creative as the stakeholders can brain- storm and compare the impact of scenarios. Effectively this approach enables iterative planning, producing multiple scenarios and compar- ing them in real time. | New capability - producing & comparing multiple scenarios of Portfolio Plan to select the optimal roadmap New capability - iterative planning is enabled to evaluate the Portfolio Plan and fine-tune it in more cycles during the same duration All stakeholders view the same Portfolio Plan, project roadmap for the year, straight after it is generated by Aangine. No delays, no misun- derstandings. That includes Business Unit Directors, Resource Manag- ers, PMO and others. |

| Approval & Baseline | Project Managers asked to enter projects into HP PPM manually, add all resource allocations, and work break- down structure - based on instructions from the PMO. That was a lot of manual work across hundreds of projects and proved to be error-prone due to misunderstandings. | Approvals are obtained via email for the whole Project Portfolio Roadmap, making a promise of IT and PMO to deliver projects for Business Units. The roadmap is imported into HP PPM (Micro Focus PPM). For each project Aangine - project start and finish, individual phases and resource allocations. | Saving the time of Project Managers (no more manual entry of new projects into Micro Focus PPM manually) Eliminating errors in project planning (it is Aangine providing the project informa- tion automatically ‘as approved’ to Micro Focus PPM) Misunderstandings are minimized |

2.2 Benefits

What makes the implementation of Aangine at Yapı Kredi quite unique is the fact, that the Portfolio Office made an effort to measure the actual impact of automating the Project Portfolio Planning.

The benefits listed here are credited by Yapı Kredi to Aangine as much better approach to Scenario Planning on Portfolio-level compared to manual Excel-based Portfolio Planning.

3. Integration with PPM Solution

The aim of this part of the case study is to provide the context of the Project Portfolio Management toolset eco-system at the bank. It was confirmed by Yapı Kredi that Aangine complements any Project & Portfolio Management tool very well.

In case of Yapı Kredi it had been Micro Focus PPM (formerly HP PPM) deployed in 2009, mainly for the following processes:

- Demand Management,

- Project Management,

- Resource Management,

- Time Management,

- Program Management,

- and Project Control Management.

Aangine went live at Yapi Kredi in the second half of the previous year, timely enough to take part in the Portfolio Planning for the next year.

As part of the implementation, Aangine was integrated with Micro Focus PPM in a bi-directional way. First, Projects Requests together with additional resource-level and schedule-level details are imported into Aangine at the beginning of the planning. Secondly, the final and approved Portfolio Plan is baselined by Aangine and imported to Micro Focus PPM in the level of each individual project, its start and finish date, major phases, and including the resource-pool allocation details.

As in many other organisations, some Project Managers prefer using MS Project Professional to work on their project schedules, importing them to Micro Focus PPM once the changes are made.

The last tool to mention is Jira, which is used by Yapı Kredi for task management by Software Development teams. There was no integration between Jira and Aangine delivered, as all information needed for planning and for on-going tracking of progress is provided to Aangine by Micro Focus PPM.

4. Enhancements Made In Following Years

Based on the success of planning with Aangine, Yapı Kredi started to plan the Project Portfolio for the horizon of 3 years instead of just 12 months. That was a major change happening in the planning, which could only successfully take place thanks to Aangine. As you can imagine, keeping such an extensive set of Excel-spreadsheets would simply not be viable.

Yapı Kredi started to plan more projects as part of Portfolio Planning, namely Agile Software Development projects and additional IT/Business project type was added into the Portfolio Planning.

Program Planning was added into the Portfolio Planning as a new addition. Programs at Yapı Kredi span beyond a year period and were recognised to be included in the planning. Compared to the manual planning period, as described above, this was a new addition to the capability of PMO. During Manual Planning, there were very few Programs planned due to limited planning capabilities. Thanks to Aangine, Yapı Kredi could include multi-year programs into the planning and expand the planning window from 12 months to 3 years.